IMA Analysis

Thursday January 25, 2024

IMA India's Q4FY24 BCPI - Highlights - January 2024

IMA’ quarterly Business Confidence and Performance Index (BCPI) survey tracks the business outlook of organisations across industries. Regularly conducted for over a decade, the headline BCPI index is strongly correlated with economic growth, and thus, is a good lead indicator of future GDP data releases. Over 155 CEOs and CFOs responded to the Q4 FY24 edition of the survey. Respondents were asked for their outlook on current and future macroeconomic conditions and business performance parameters such as sales, new orders, net profit, net hiring and capacity utilisation. Further, they were asked about their capex plans and their spending on things such as marketing and advertising, team-building exercises and travel. This is a summary of the full report that was shared with respondents, which includes size-, sector- and industry-wise expectations.

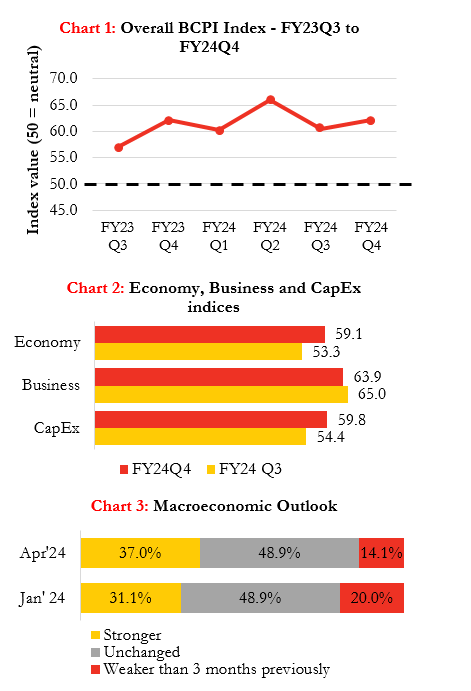

After a 6-point dip in October, the BCPI saw a modest, 1.6-point increase, to 62.1, in January 2024 (Chart 1). This has primarily been driven by an improvement in the macro-economic index, which rose by 5.8 points, with fewer businesses expecting conditions on the ground to worsen by April (Chart 3). Capex intent has also improved, rising by 5.4 points. Counter-balancing these positives is a 1.1-decline decline in the business-performance index (Chart 2).

Some highlights from the report:

- The largest companies are most optimistic about the economy, capex intent and business performance in Q4.

- Sector-wise, it is a mixed bag with 4 of 8 sectors we track expecting improvements and the others treading downwards.

- Manufacturing companies have taken the lead this quarter, pushing ahead of services companies in terms of their overall sense of ‘optimism’ about the economy and their own performance. This aligns closely with recent GDP data.

- Sales growth and capital expenditure are expected to strengthen, whereas, new orders, profitability, capacity utilisation and new hiring may decline.

- Spending on advertising, travel and team-building efforts are projected to stabilise in the January-March quarter.

Copyright ©️ 2021-22 INTERNATIONAL MARKET ASSESSMENT INDIA PRIVATE LIMITED. All rights reserved