IMA Analysis

Monday April 5, 2021

Gender Gaps in Boards - April 2021

Insights from IMA India’s 2020 Executive and Board Remuneration Report

IMA recently published the 2020 edition of the Executive and Board Remuneration Report. Based on an extensive database of over 16,000 individual Directors for more than 1,800 companies, the report offers an exhaustive analysis of trends in pay and governance practices, with splits by multiple segmentation parameters. This paper highlights some of the analysis around gender representation and male-female pay-gaps at the Board level in India Inc.

RISING ‘DIVERSITY’ – BUT LIMITED REPRESENTATION

The headline diversity numbers are improving…

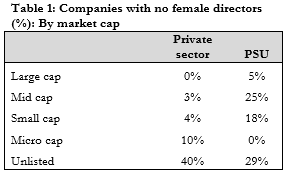

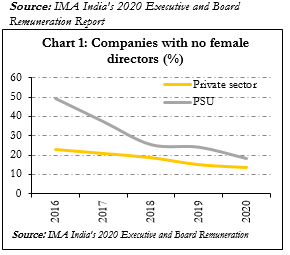

In a broad sense, gender diversity at company Boards is improving: with each passing year, there are fewer and fewer companies that have no female directors on the Board. Within the private sector, the ratio of all-male Boards has fallen from ~23% in FY16 to ~13% today (Chart 1). The ratio varies by company size, sector and market cap, but in the biggest private-sector organisations, it is now vanishingly small (Table 1). PSUs have seen a much steeper improvement, to 18% but from a much higher base of 50% in FY16.

…but women continue to encounter the glass ceiling when it comes to top-executive roles

The problem with headline numbers is that they often conceal more than they reveal. Even if most companies now have at least one woman on the Board, very few women hold the top-executive positions. As of FY20, roughly 20% of all NEDs (non-executive directors) were female, as were 27% of Company Secretaries. However, women accounted for only ~5% of CMDs, CEOs, CFOs and Non-Executive Chairmen. The ratio is somewhat better (13%) for EDs (executive directors) outside of these top 3-4 levels, but is still far from ideal. There are also variations by sector and ownership – foreign MNCs and BFSI, general services and healthcare firms have higher-than-average representation in the top-executive positions – but company size is not meaningfully correlated with greater diversity.

PAY GAPS: LARGE AND SYSTEMIC

On average, women are paid less than men at the Board level

Female directors also appear to be at a disadvantage when it comes to the quantum and structure of pay. For a variety of reasons, including career choices and family obligations, gender pay-gaps are a fact of life in most countries and across seniority levels. However, our data suggests that it is also a systemic issue. Across most Board positions, and among both private and PSU companies, the average male in FY20 earned anywhere from 9% more (CEO) to double (Company Secretary) of what the average female did. The ED level is an exception: here, on average, females earned 13% more.

Comparisons are fraught with statistical issues…

…but women are consistently paid less even at the NED level…

…receive smaller pay increases…

At the top-management levels, direct apple-to-apple comparisons are admittedly tricky. Unlike with junior or mid-management, any given company will rarely have more than one CEO, CFO or CMD at one time, or even in the same year. Compensation also depends on company size, ownership, profitability, sector of operation and – of course – individual performance. Thus, it may seem simplistic to compare ‘average pay’ across a group that is far from homogenous. Yet even splitting numbers across these various bands, the data shows that women generally earn less than men. Most convincingly, there is a small-yet-significant (6% on average, widening to nearly 30% among small caps) difference even at the NED level, where there are multiple individuals (often of both genders) occupying the role concurrently, and where the overall compensation is guided to a large extent by factors that are common to all NEDs. Worryingly, pay increases for female executives, for most positions, are also lower than for men. CFOs and Company Secretaries are an exception, with female pay growing slightly faster over a four-year period.

…and take home a smaller ‘assured’ amount

Females appear also to lose out in terms of pay structures. Barring the Chairman position (either executive or non-executive), female executives and directors consistently earn a higher share of their total compensation in the form of variable pay. On the face of it, this might not seem like a bad thing – it may even suggest that they are being rewarded more strongly for performance. However, combined with the fact that they earn less overall, this implies that female directors have a much smaller assured pay package than do males.

|

This paper is based on IMA India’s 2020 Executive and Board Remuneration report, a detailed analysis of compensation, performance, independence and composition of Boards amongst listed and unlisted companies in India. The analysis covers data for over 16,000 individuals across 1,800 companies in various industry sectors and across the market capitalisation spectrum. It presents data in highly segmented formats to enable both high level trend analysis as well as fine peer comparisons. The report is available for purchase from IMA’s offices or online at https://www.ima-india.com/reports/DC_Report_2020/ . |

Copyright ©️ 2021-22 INTERNATIONAL MARKET ASSESSMENT INDIA PRIVATE LIMITED. All rights reserved